Qraft Teams With LG AI Research to Offer Pioneering AI-Powered ETF

Qraft Technologies took AI-driven investment products to the next level with the launch of the LG-QRAFT AI-Powered U.S. Large Cap Core ETF (LQAI) in November of 2023. The firm partnered with LG AI Research, an artificial intelligence (AI) research hub of South Korea's LG Group, to create LQAI. The fund incorporates artificial intelligence into its management even more thoroughly and seamlessly than any of its predecessors.

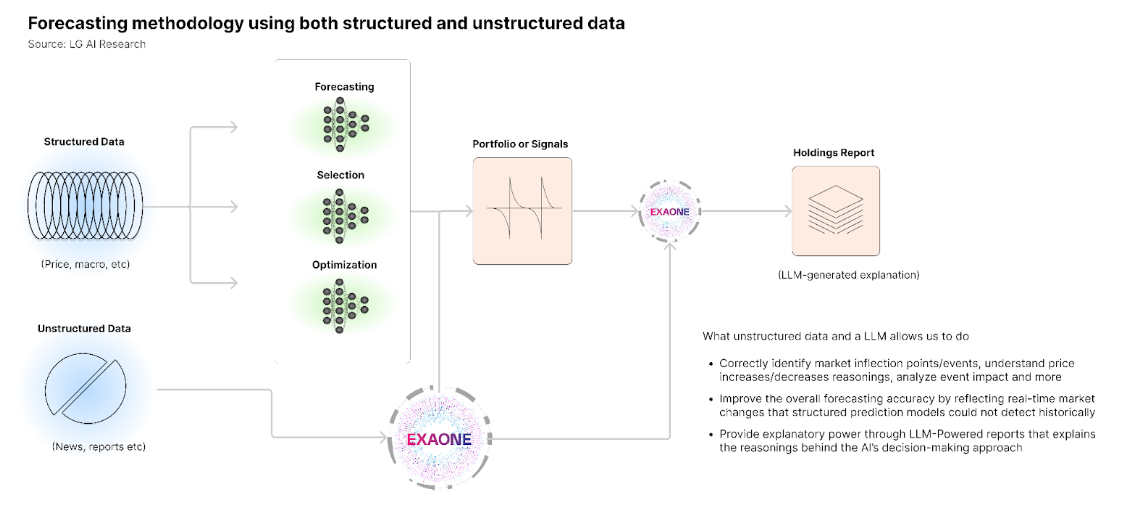

Qraft entered the ETF market for the first time five years ago, launching two actively managed funds powered by artificial intelligence – the Qraft AI-Enhanced U.S. Large Cap ETF (QRFT) and the Qraft AI-Enhanced U.S. Large Cap Momentum ETF (AMOM). Those two early funds relied mainly on structured data – numerical inputs, basically. However, LQAI leverages the technology developed by LG AI Research to analyze unstructured data, which is generally text. That means that LQAI’s underlying AI algorithm can analyze the textual references to companies in the selection universe in addition to structured data. From there it synthesizes all that data in order to arrive at a decision as to whether the company should be in the portfolio.

In taking into account both structured and unstructured data, the algorithm’s investment decisions are influenced not just by the numerical data that is used by traditional models, but also by the sentiment around a company that the algorithm evaluates via those textual references. In other words, LQAI looks at a much more comprehensive picture than your average quantitative actively managed fund by adding in this extra dimension of real world opinions about a company.

Let’s be clear – this is not the first ETF to incorporate sentiment into its investment decisions. There are a few funds that have been doing it for years. However, these use a method similar to statistical analysis such as identifying how many times a word was mentioned in an available data set rather than analyzing the meaning behind those references. LQAI’s AI algorithm interprets those textual references in the unstructured data to determine the sentiment around the stock and incorporates that information into its investment decisions.

How LQAI Works

The fund’s algorithm takes the ultimate bottom-up approach with its investment universe consisting of the large-cap stocks trading on the U.S. market. As such, it applies the same analytical process based on 20 years of data to each of those stocks.

That approach has three layers that each rely on a model – also known as an agent – that compile and interpret the data to respectively create a forecast for each stock, rank it and assign it a weight, with only the top 100 stocks selected for the portfolio.

Each agent in the selection process has a similar level of cognition to the likes of ChatGPT and other deep learned models out there. This ensemble of agents enables the comprehensive analysis of vast datasets while maintaining the ability to hone in on specific tasks and objectives, such as monitoring and predicting particular stock prices., notes Young Choi, Director at LG AI Research.

The model's reliance on unstructured data allows it to dynamically adapt to the conditions of the market, according to Choi. He says that the model tends to leverage more on the unstructured side in a risk-off environment when there's more uncertainty and the market is in a decline. In these scenarios, real-time news sentiment definitely increases the robustness of the model and ultimately enhances the forecasting accuracy.

Despite the lack of human involvement, the means through which LQAI’s overarching model arrives at its portfolio each month is not a black box. The use of unstructured data in conjunction with the model’s generative capabilities means that the model can generate a detailed report that explains its reasoning for selecting different stocks with all the detail that one might find in a regular fund report.

A Different Kind of Active Management

With its almost complete lack of human involvement in its management process, LQAI stands with a small, select number of AI-driven ETFs. Generally, an actively managed fund - even a quantitatively managed one - leaves some sort of room for human discretion or intervention.

LQAI, however, replaces that human angle with its use of unstructured data. By taking into account and interpreting the sentiment captured by that information, it is incorporating human opinion but also synthesizing far more data than any individual fund manager could process on their own.

And like a human, the model can learn and adjust its approach accordingly. LQAI’s model will only become more sophisticated over time as it ingests and interprets more and more data. Essentially, AI has replaced the human element of active management and found a way to replicate human analysis on a much broader scale with far more inputs.

How LQAI Stacks Up

When comparing LQAI’s top holdings to those of SPY, there are a lot of similarities and some glaring differences. For example, while Tesla is no longer included in the top 10 for SPY, it appears among the top holdings of LQAI. Similarly, Advanced MicroDevices and Ford Motor Co. are currently included in LQAI’s top 10 but not in SPY’s.

When it comes to sector distribution, Information Technology has almost the exact same weight in LQAI as it does in SPY. That’s not surprising given that the fund tends to take more of a beta approach when markets are rallying - technology has been on a tear for some time and is up well over 20% year-to-date. LQAI also significantly overweights Real Estate, Consumer Staples and Utilities, while having notable underweights in Industrials and Financials, as well as Healthcare.

These differences are where LQAI’s edge lies. Active management has long been known to underperform passive management over time. It is very difficult for portfolio managers to achieve better results than a cap-weighted index covering the same asset class. The human factor - and the biases that go with it - in active management is generally detrimental to results.

However, LQAI’s approach combines vast amounts of purely numerical data with the equally vast body of publicly available sentiment. Its portfolio isn’t the result of decisions made by a portfolio manager or even a team of portfolio managers, but rather the result of rigorous analysis of the available data sets. The outcome is a portfolio that differs from a cap-weighted approach where it matters.

The most recent report from LQAI notes that NVDA and AAPL are heavily weighted in the portfolio at least in part due to the surge in artificial intelligence and semiconductor demand, which has significantly boosted their market positions. This AI boom is one of the top factors that has driven NVDA’s stock up. The change is so dramatic that NVDA has begun to claim a larger weight than Apple in certain major passively managed technology ETFs.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a prospectus or summary prospectus with this and other information about the Fund, please call 1-855-973-7880 or visit our website at www.qraftaietf.com. Read the prospectus or summary prospectus carefully before investing.

The Funds are distributed by Foreside Fund Services, LLC

Investing involves risk, including loss of principal. The Funds are subject to numerous risks including but not limited to: Equity Risk, Sector Risk, Large Cap Risk, Management Risk, and Trading Risk. The Funds rely heavily on a proprietary artificial intelligence selection model as well as data and information supplied by third parties that are utilized by such model. To the extent the model does not perform as designed or as intended, the Fund’s strategy may not be successfully implemented and the Funds may lose value. Additionally, the funds are non-diversified, which means that they may invest more of their assets in the securities of a single issuer or a smaller number of issuers than if they were a diversified fund. As a result, each Fund may be more exposed to the risks associated with and developments affecting an individual issuer or a smaller number of issuers than a fund that invests more widely. A new or smaller fund's performance may not represent how the fund is expected to or may perform in the long term if and when it becomes larger and has fully implemented its investment strategies. Read the prospectus for additional details regarding risks.

LG QRAFT AI-Powered U.S. Large Cap Core ETF: Returns on investments in securities of large companies could trail the returns on investments in securities of smaller and mid-sized companies or the market as a whole. The securities of large-capitalization companies may also be relatively mature compared to smaller companies and therefore subject to slower growth during times of economic expansion. Large-capitalization companies may also be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes. The market price of an investment could decline, sometimes rapidly or unpredictably, due to general market conditions that are not specifically related to a particular company, such as real or perceived adverse economic or political conditions throughout the world, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally. In pursuing the Fund’s investment objective, the Adviser consults a database generated by the LG-Qraft artificial intelligence system, which automatically evaluates and filters data according to parameters supporting a particular investment thesis. For the database, LG QRAFTAI selects and weights portfolios of companies in the Universe listed on the New York Stock Exchange and NASDAQ to provide a balanced exposure to a variety of factors affecting the U.S. market including, but not limited to, quality, size,value, momentum, and volatility. The Fund expects to hold 100 companies in its portfolio. While it is anticipated that the Adviser will purchase and sell securities based on recommendations by the U.S. Large Cap Core Database, the Adviser has full discretion over investment decisions for the Fund.

SPDR S&P 500 ETF Trust (SPY)

Investment Objective: The Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Index”).

SPY seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the Index.

Costs & Expenses: 0.09% gross and net expense ratio

Liquidity: As with all exchange-traded funds, Fund Shares may be bought and sold in the secondary market at market prices. The trading prices of Fund Shares in the secondary market may differ from the Fund’s daily net asset value per share and there may be times when the market price of the shares is more than the net asset value per share (premium) or less than the net asset value per share (discount). This risk is heightened in times of market volatility or periods of steep market declines

Risk: The fund is subject to risks including, but not limited to, passive strategy/index risk, index tracking risk, and equity investing risk.

Guarantees or Insurance: An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Fluctuation of Principal or Return: As with all investments, there are certain risks of investing in the Trust, and you could lose money on an investment in the Trust.

Tax Features: The Trust will make distributions that are expected to be taxable currently to you as ordinary income and/or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or individual retirement account.

Website: https://www.qraftaietf.com/lqai