Factor Investing Gets an Upgrade

If you’ve been actively investing for quite some time, you understand that constructing an optimal portfolio is a challenging task — especially when faced with millions of securities and dozens of asset classes to choose from. But we believe in order to enhance diversification and generate above-market returns, you need a wide exposure to different investment approaches.

One way is to know the drivers, or the factors that explain the higher return attributes. Quants identify this strategy as factor investing. And just as understanding the right nutrients contained in our food can help us build a balanced diet, knowing the factors of securities that have brought higher returns can help us select the right mixture of assets and strategies in our portfolio. Ultimately, the goal of factor investing is to generate higher returns, reduce risk, and improve diversification.

Foundations of Factor Investing

Factors can be broken down into two main types: macroeconomic and style. Macro factors like the economic growth and inflation rate capture the broad risks across asset classes while style factors explain the returns within those asset classes. The following five outline the key characteristics of common style factors:

1. Value: Stocks that trade at lower price relative to their fundamentals tend to outperform the market over time. The idea is that when market overreacts to news — whether good or bad, stock prices tend to fluctuate. This overreaction usually provides investors with the opportunity to buy stocks at a discounted price.

2. Momentum: Stocks that have outperformed in the past tend to continue performing well in the near future. With momentum, investors buy upward trending stocks to maximize long-term profits and sell them once they’ve reached their peak. A common way to measure momentum is to classify stocks by a 12-month timeframe.

3. Size: Stocks with a market capitalization between $2 billion and $10 billion that, historically, have outperformed large cap stocks with a market capitalization of over $10 billion. With the size factor, investors can adjust their portfolios to include more small cap companies to potentially improve returns.

4. Volatility: Stocks with low volatility tend to outperform more volatile companies. Extensive research shows that low volatility stocks tend to outperform more volatile companies and the broader market over time.

5. Quality: High-quality stocks that showcase more stable earnings, stronger balance sheets, and higher margins have tended to outperform the market over time. To put simply, companies that exhibit high profitability have shown to advance more quickly in the market than those that do not.

Potential Benefits of Factor Investing

Factor strategies offer a complementary approach to the traditional active and passive investing. Since the introduction in 1976, a growing number of retail and institutional investors have adopted factors to gain more control and transparency of their portfolios.

One reason for this is that factor investing is designed to minimize risk and increase diversification. Factors cover a wide variety of attributes and investors can select whichever ones that better suit their needs and goals. For example, investors who want downside risk management in a volatile market can integrate volatility factors to help offset risk. Likewise, investors who welcome risk and want more potential returns can add momentum factors to their portfolios. Whatever the case may be, factors provide a great way for investors to address specific needs and/or desired outcomes.

Furthermore, factors are not limited to just the five attributes mentioned above. There are hundreds, if not thousands, more that have emerged over the years. While some can be ineffective, others can provide unique exposure to market opportunities. For example, some factors capture investor behaviors that offer a contrarian perspective — meaning, they offer investment opportunities by tracking behavioral biases. Others may include taking on additional risk to bring better potential returns.

Replacing Quants with AI

Factors are created through quantitative investment strategies. These strategies are centered around exploiting market anomalies, which go against the efficient market hypothesis (EMH) that asset prices reflect all available information. Thus, anomalies reveal moments when securities perform contrary to the notion of efficient markets. What quantitative analysts do is they research and backtest models to identify these anomalies and design strategies to best extract them.

Due to the inductive nature of market anomalies and the complexity of mathematical and statistical models, hedge funds and institutional investors rely heavily on the competence of quants and their ability to discover new anomalies.

But in the advent of new technology and AI as well as the ever-changing world of financial markets, are quants actually worth the hire? In other words, can AI do exactly what quants can do, but better?

We propose that yes, AI can do exactly just that. And not just better, we believe that AI can provide faster results at a much lower cost.

Introducing Qraft’s Factor Factory

Factor Factory is Qraft’s core research technology that automatically finds factors that could bring excess returns. After receiving clean data through Kirin API, Factor Factory is able to leverage AutoML technology to produce at least 10 factors per day without any human intervention. To get a clear picture of what Factor Factory is, let’s first consider the four main components that make up the framework:

1. Universe: The universe determines the pool of stocks that form a portfolio. Having a wide access to different types of securities and asset classes is important because a factor can vary according to the universe setting. Qraft’s Kirin API effectively manages four different types of investment universes:

a. Class A Stocks

b. Security Types (common stock, preferred stock, ADR, etc.)

c. Exchange Types (NYSE, NASDAQ, AMEX, NYSE_ARCA, OTC, etc.)

d. Minimum Cap Standards

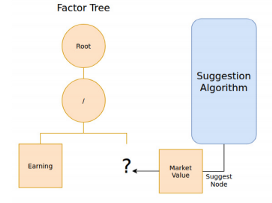

2. Expression Tree: A factor is expressed by the Expression Tree, as shown below.

In order to complete one Expression Tree, three different types of nodes are considered: operator, normalizer, and data. With the available financial data received from Kirin API and using the three available nodes, a factor formula is created with robust alpha.

3. Discovery Algorithm: The discovery algorithm determines which nodes will be used to create a new factor. Factor Factory currently uses two separate discovery algorithms: random search and reinforcement learning.

a. Random Search: As the name suggests, random search completes a factor by recommending random nodes. While the method is pretty straightforward, it often produces results that are compatible to other complex methods. Additionally, unlike the reinforcement learning method, there is no indirect processing time in the search, so many factors can be completed in a short period of time.

b. Reinforcement Learning: While random search method has several benefits, one major downside is not being able to explore the space efficiently. The discovery algorithm goes over various combinations of 111 financial data as well as operators. In order to effectively explore such large space of data, a method other than random search is required. One method is the reinforcement learning method using deep learning algorithms.

4. Verification Process: Factors that are created undergo an evaluation process that test the robustness of alpha. There are two parts to the process: portfolio construction and verification indicator.

a. Portfolio Construction: The composition of a portfolio varies depending on the consideration of a long-short strategy, how many shares are included in the portfolio, whether to set a market capitalization limit, and how the rebalancing period is determined. The calculation is done in a parallel, considering the number of portfolio cases computed for the various conditions applied to the actual investing.

b. Verification Indicator: To verify the efficiency of the factor produced by Factor Factory, several verification methods are applied. The final verification indicator value for use in reinforcement learning consists of a combination of the many verification methods that are currently available.

Rediscovering Well-Known Factors with AI

To showcase the effectiveness of the factor search and verification algorithm, we ran a simulation test in our server room. After having run through the computing power for one day, Factor Factory was able to find several well-known factors. These factors were discovered automatically with AI from scratch and without any human intervention.

What this shows is that AI can indeed discover factors in one single day that major quants and people with Ph.Ds. spend years doing. AI has far better capabilities to explore unreached space and construct more sophisticated models. And AI can do this without adding any information or bias prior to the search.

Best Takeaway

Factor investing has been around for quite some time and there’s no denying that the importance of factors has shifted how investors construct their portfolios. A 2018 survey from the Invesco Global Factor Investing Study found that over 70% of institutional investors have integrated factor strategies as a complementary approach to the traditional active and passive investing. Qraft’s Factor Factory is, at its core, a framework that automates the process of finding robust alpha factors with AI technology. With the data processed by Kirin API, Factor Factory can explore hundreds of market anomalies in a single day. No longer do hedge funds and institutional investors need expensive quants to do the heavy lifting.

After finding robust alpha factors, Qraft then leverages what’s called Strategy Factory to extract strategies and construct portfolios seeking high returns.

— — — — — — — — — — — — — — —

Investing involves risk including possible loss of principal.

Artificial intelligence selection models are reliant upon data and information supplied by third parties that are utilized by such models. To the extent the models do not perform as designed or as intended, the strategy may not be successfully implemented. If the model or data are incorrect or incomplete, any decisions made in reliance thereon may lead to the inclusion or exclusion of securities that would have been excluded or included had the model or data been correct and complete. Service providers may experience disruptions that arise from human error, processing and communications error, counterparty or third-party errors, technology or systems failures, any of which may have an adverse impact.

— — — — — — — — — — — — — — —

Quant is short of quantitative analyst who works in the financial industry and uses mathematical methods.

Kirin is Qraft’s in-house data platform that integrates multiple vendors to provide both macroeconomic and company fundamentals with the correct point-in-time data.

AutoML technology is short for Automated Machine Learning. It’s essentially the automation of the machine learning process to make machine learning jobs simpler, easier, and faster.

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index.

Long/short equity is an investing strategy that takes long positions in stocks that are expected to appreciate and short positions in stocks that are expected to decline.